This Prudential study reveals how student loan debt for many graduates has become a profound source of both financial and emotional stress, compromising their ability to establish families and households, save adequately for retirement, and protect themselves against unexpected life events.

Key findings include:

- Americans are starting to question whether college debt is “good debt”.

- Many students borrow for school without understanding the terms of their debt.

- Student loan debt is impacting borrowers’ financial and emotional wellness.

- Current students and graduates alike continue to affirm the benefits of going to college.

- Graduates’ experiences suggest a better way forward for current and future students, and they recommend best practices and action plans.

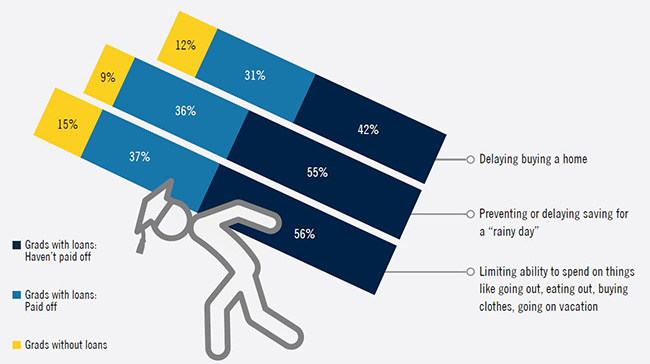

- College costs, debt can impact the ability to save, buy a home, and socialize with others

The survey findings highlight both the troubling and encouraging facts surrounding student loan debt. Of concern is the trend showing many students don’t know what type of loans they took out, their loan terms, or if they had a co-signer for their loans.

The positive takeaways confirm that the vast majority of graduates and current students say they would still go to college even if they had known more about the financial challenges when they started. And they continue to value the potentially life-changing benefits of higher education.

To help others make smarter choices about paying for college, the study presents some best practices and action plans for future students, current students, and recent graduates.

To view the full report, download Student Loan Debt: Implications on Financial and Emotional Wellness.

0303438-00002-00